Table Of Content

It's always wise to seek guidance from a real estate professional or financial advisor for personalized advice, as they can provide more nuanced insights into property investments. To do that, multiply the initial purchase price by one plus the appreciation rate raised to the power of the holding period. A home appreciation calculator is a tool used to calculate a subject property's appreciation rate and price over a specified period. An appreciation calculator will compile past and current data points, analyzing their differences relative to the property’s holding period. The location of a property plays a vital role in determining its appreciation potential. Desirable neighborhoods with good schools, amenities, and transportation infrastructure often experience higher appreciation rates.

Can a real estate agent help me get an accurate home valuation?

If you’re a real estate investor, home appreciation is a term you need to be intimately familiar with. It’s one of the key factors that can determine the profitability of your investment. When a property appreciates, it increases in value, which can lead to a higher return when you decide to sell or rent out the property. In fact, many investors bank on appreciation as a significant part of their investment strategy. For most people, their homes will be their biggest purchase in life and many are wondering if buying a house is a good investment.If you need a place to live, then a house is a good investment. Things that impact the appreciation rate of a home are the surrounding neighborhood.

Annual Report to Congress

The cost of a loan or mortgage plays a major role in the sale price of a home, and thus impacts the appreciation. During periods when interest rates are high, the value of homes tends to decrease and they become more difficult to sell. The truth is, home appreciation can have a significant impact on homeowners and investors. It can increase the value of your home, build equity, and contribute to financial growth. However, it’s important to have realistic expectations and understand that home appreciation is influenced by many factors. With this home appreciation calculator you are able to find out how the value of your home has changed over a time.

Appraisal and Assessment: Core to Real Estate

If you want to select a home that appreciates over time, you need to find a good location.

How To Use A Rent Vs. Buy Calculator - Forbes

How To Use A Rent Vs. Buy Calculator.

Posted: Sat, 26 Mar 2022 07:00:00 GMT [source]

Target sales price

For this example, we are going to use a property with a current value of $300,000 an appreciation rate of 5% and a timeline of 10 years. Select whether you would like to calculate the future value of your home or the homevalue appreciation rate using the drop-down menu. Finally, once you have the final variable (the appreciation rate), you can calculate the price appreciation in a given period. First, divide the difference between the current home value and the initial purchase price by the initial purchase price. To calculate the home’s appreciation, you will need its current value and the current date. To be clear, a home appreciation calculator can’t predict how much a home will appreciate, but it can estimate how much someone can expect an asset to increase in value.

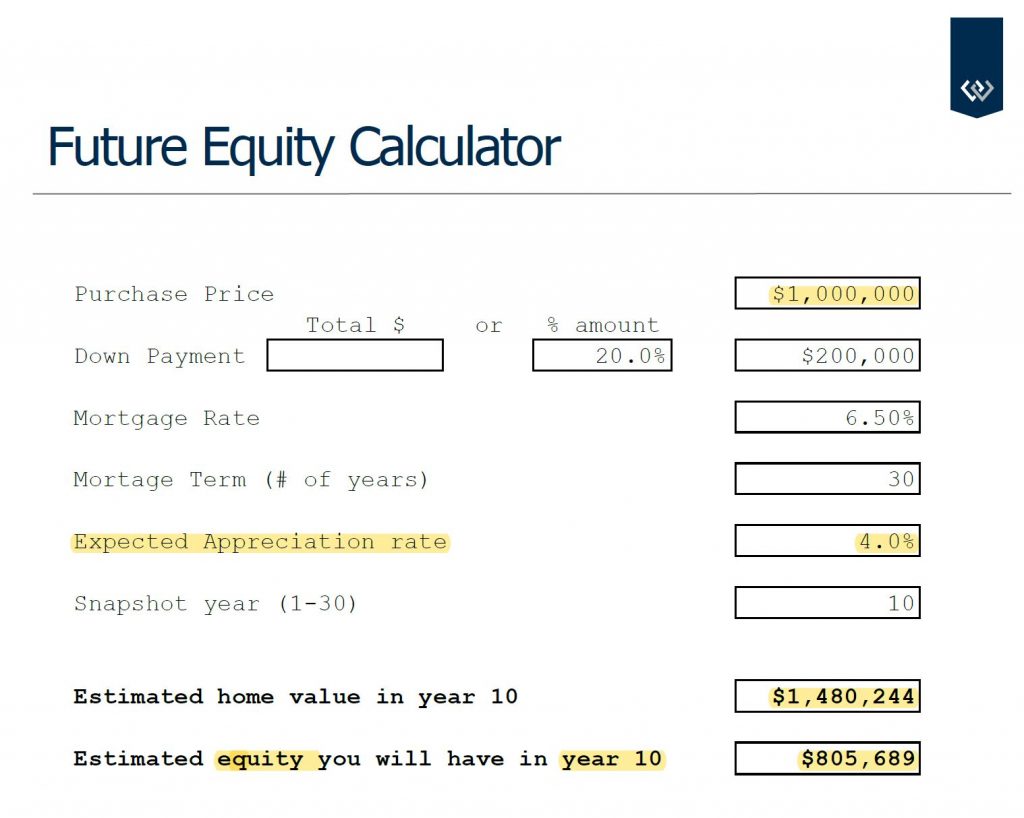

The target sales price is the amount of money that you’re hoping to get for your home when it comes time to sell. For the purpose of the calculator, make an educated estimate off the top of your head. However, when it comes time to sell, you’ll want a more concrete value. Your down payment is the initial money that you pay for a piece of real estate.

Understanding how to calculate home appreciation is a required skill for any real estate investor. Fortunately, there is a straightforward formula that you can use to work out the future value of your house. Home appreciation relates to a house or investment property increasing in value over a period of time. A raised value of a property can lead to the owner making a profit upon selling it or earning more income through monthly rent from their tenants. Knowing how home appreciation rates work and what they are in your neighborhood can help you to make the best choices for your financial security. Imagine you purchased a home in California for $500,000 five years ago.

Salary & Income Tax Calculators

Are there businesses such as restaurants, supermarkets, delis near the house? This is a realistic estimate of property appreciation rates in your area. Whether you’re a homeowner looking to track your property’s growth or a prospective buyer evaluating potential investments, the Home Appreciation Calculator by Zip Code is an invaluable resource. By understanding the factors that influence home appreciation and utilizing this innovative tool, you can navigate the complexities of the real estate market with confidence. Next, enter the purchase price of your home, the purchase date, and the sale date.

Obviously there are lots of real estate investors that will be aiming for returns that are greater than 2% annually. For instance, fix and flip investors aim for a net profit of 10% or higher. However, they are able to increase their ROI by completing renovations that are known to increase the value of a home. They also have various techniques for finding properties that can be purchase for below market value.

If you’re looking to buy a house, and do not have a mountain of cash saved up, you’ll need to consider getting a mortgage to help you finance this... It’s likely that your mortgage loan will be the largest loan you have during your lifetime. Some homebuyers refuse to purchase a property if it is part of a property owner association. When you buy a house and start making mortgage payments, your payment consists of four different components, known... It may seem simple, but even just a fresh coat of paint can help to enhance your curb appeal and protect your investment.

While the formula works well to get a general idea of home appreciation, there are some additional factors to keep in mind. Laura started her career in Finance a decade ago and provides strategic financial management consulting. Finally, the condition of your home and any improvements you make can also affect its appreciation.

To estimate the current value you’ll need to get an appraisal, perform a competitive market analysis, or use a real estate website for a very rough estimate. We’ve learned about home appreciation, how to use a Home Appreciation Calculator, and the impact of appreciation on home value, equity, and real estate investment. Refinancing can be a strategic move, influenced by the assessed value of the house, current credit situation, and prevailing interest rates. Calculators, especially those designed for specific zip areas, can help estimate the potential benefits and net profit from refinancing.

The process of appraisal and assessment involves professional appraisers and various tools. They analyze and assess the house to determine the appraised and assessed values. These figures are essential for calculating the loan-to-value ratio, influencing decisions like refinance and credit. Whether you’re a homeowner planning for retirement or a real estate investor looking for your next big opportunity, understanding home appreciation is crucial. This basic desktop calculator is versatile and durable, designed to withstand the demands of daily use in various environments.

Calculate the appreciation of a home or asset using our appreciation calculator. Brad Smith is an experienced interior designer and the founder of OmniHomeIdeas.com. With a Master's degree in Interior Design from Pratt Institute and a passion for creating safe and healthy living spaces, Brad shares his expert insights and innovative design ideas with our readers. His work is driven by the belief that home is where every story begins. Amplify Credit Union provides fee-free banking and award-winning lending throughout Texas. And with members in all 50 states and worldwide, Amplify is here with the financial services you need no matter where life’s journey takes you.

Location, location, location—it’s the chant of the real estate realm, echoing through the air like the whispers of Mikey williams on the court, hinting at potential greatness. Your dynamite domicile’s value could skyrocket or fizzle based on its zip code. Peek into the best States To raise a family and choose a winner where your investment might just do a victory lap. In a world where calculators are as plentiful as stars in the sky, Mortgage Rater has served as your guide through the clutter. We’ve lifted the veil on the best home appreciation calculator of 2023, so you can stride forth with clarity, armed with the tools to make your real estate dreams a towering reality.

No comments:

Post a Comment